Understand this upfront: Canada doesn’t offer federal tax rebates for solar panels like the United States does. If you’ve been searching for information about federal solar tax credits in BC, you’re likely finding confusing results mixing American IRS incentives with Canadian programs. The good news? British Columbia residents access different financial support that can be even more valuable. Provincial programs like the CleanBC rebates, combined with net metering benefits from BC Hydro, deliver substantial savings on solar installations. Many BC homeowners also go solar without upfront costs through power purchase agreements, eliminating the need for any rebate or tax credit entirely. Understanding what’s actually available in your province means you’ll avoid wasting time chasing American tax incentives that don’t apply here, and instead focus on legitimate pathways to reduce your energy bills while supporting BC’s clean energy goals.

The Truth About Federal Solar Tax Rebates in Canada

If you’ve been searching for “federal tax rebates for solar panels,” you might be surprised to learn that Canada doesn’t actually offer federal tax credits or rebates for residential solar installations. This is quite different from the United States, where homeowners can claim a federal solar tax credit directly on their income taxes.

This common misconception exists because most online solar information comes from American sources, and US-style tax credits receive significant media attention. When Canadians search for solar incentives, they often encounter US-focused content that doesn’t apply north of the border. Additionally, the term “tax rebate” has become synonymous with solar savings in popular conversation, even though Canada’s support system works differently.

Rather than tax credits, the Canadian federal government provides financial support through direct grant programs. The most notable example was the Canada Greener Homes Grant, which offered up to $5,000 for eligible energy-efficient home improvements, including solar installations. While this program has now closed to new applicants, it demonstrated the federal approach: upfront grants rather than tax deductions.

Understanding this distinction matters for your planning. Tax credits reduce what you owe at tax time, while grants provide immediate cash assistance toward installation costs. For BC residents, this actually works in your favor. The province has developed some of the most generous solar incentive programs in Canada, offering rebates and net metering arrangements that provide predictable, immediate savings rather than waiting until tax season.

The key takeaway? Stop searching for federal tax rebates and start exploring what’s actually available. BC’s provincial programs, combined with utility-specific incentives, often deliver better financial outcomes than tax credit systems. Let’s look at what you can actually access as a BC homeowner.

BC’s Provincial Solar Incentives That Actually Save You Money

PST Exemption on Solar Equipment

British Columbia residents benefit from a significant Provincial Sales Tax (PST) exemption that applies to qualifying solar energy equipment. This exemption removes the 7% PST from the purchase price of solar panel systems and related components, providing immediate savings when you invest in solar power.

The PST exemption covers solar photovoltaic modules, inverters, mounting hardware, battery storage systems, and installation materials directly related to your solar energy system. This isn’t a rebate you need to apply for separately—the savings happen automatically at the point of purchase when you work with registered solar installers.

Let’s look at a practical example: Consider a typical residential solar installation in Metro Vancouver costing $20,000. Without the PST exemption, you’d pay an additional $1,400 in provincial sales tax. Thanks to this exemption, that $1,400 stays in your pocket, effectively reducing your upfront investment by 7%.

For a Surrey family who recently installed a 6-kilowatt system, this exemption saved them $1,680 on their $24,000 installation. They applied those savings directly toward upgrading to a premium monitoring system that helps them track their energy production in real-time.

The PST exemption works alongside other BC incentives like the CleanBC rebate programs, creating a comprehensive package that makes solar energy more accessible. Unlike tax credits you claim later, this exemption provides immediate financial relief when you need it most—during the initial purchase. This straightforward benefit removes one more barrier for BC homeowners and businesses ready to transition to clean, renewable energy.

CleanBC Solar Rebate Programs

While federal tax rebates don’t exist in Canada, BC residents have access to valuable provincial incentives through CleanBC programs that make solar installation more affordable than ever.

The CleanBC Solar Rebate program currently offers residential homeowners rebates of up to $5,000 for installing grid-tied solar photovoltaic systems. The exact amount depends on your system size, with rebates calculated at approximately $0.80 per watt of installed capacity. For a typical 6-kilowatt residential system, homeowners can expect to receive around $4,800 back after installation.

Eligibility is straightforward for most BC residents. You must own your home, have an active BC Hydro or FortisBC account, and ensure your solar system is installed by a qualified contractor. The property must be your primary residence, and your electrical system needs to meet current safety standards. Rental properties and secondary homes typically don’t qualify under the residential program, though separate commercial incentives exist for businesses.

The application process follows a simple three-step approach. First, obtain quotes from certified solar installers who can confirm your property’s suitability. Second, submit your pre-approval application through the CleanBC website before installation begins—this step is crucial as retroactive applications aren’t accepted. Third, complete installation and submit final documentation including permits, photos, and commissioning reports within six months of approval.

Take the case of the Martinez family in Kelowna, who installed a 7-kilowatt system last year. They received a $5,000 rebate, reducing their total project cost from $21,000 to $16,000. Combined with long-term electricity savings averaging $1,200 annually, their payback period dropped to just over 13 years.

Processing times typically range from four to eight weeks for initial approval, with final rebate payments issued within six weeks after submitting completion documents. Keep all receipts and ensure your installer provides detailed invoices to streamline the process.

Net Metering Benefits

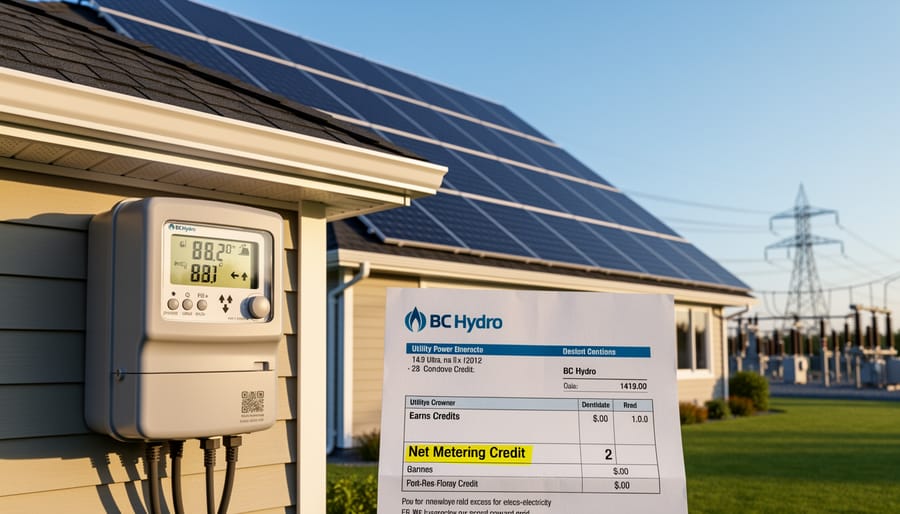

Beyond the upfront incentives, BC residents enjoy ongoing financial benefits through the province’s net metering program. This valuable system allows you to earn credits on your electricity bill whenever your solar panels generate more power than your home uses—a particularly common occurrence during BC’s sunny summer months.

Here’s how it works: When your solar panels produce excess electricity, that energy flows back into the BC Hydro grid. In return, you receive credits on your account at the same retail rate you normally pay for electricity. These credits roll over month to month for up to one year, meaning summer surplus helps offset your higher winter consumption when solar production naturally decreases.

For a typical BC homeowner with a 6-kilowatt solar system, this translates to significant savings. Consider the Johnson family in Kelowna: after installing solar panels in 2021, they now generate approximately 7,500 kilowatt-hours annually. During peak summer months, they build up credits worth $150-200 monthly. These credits carry forward to offset their $120-140 winter bills, effectively reducing their annual electricity costs by 70-80 percent.

The long-term value becomes even more compelling when you factor in rising electricity rates. As BC Hydro rates increase over time, the value of your solar-generated electricity and accumulated credits grows proportionally. Over a typical 25-year solar panel lifespan, homeowners can save $25,000 to $40,000 in electricity costs through net metering alone.

To maximize your net metering benefits, size your system appropriately for your household’s consumption patterns. BC Hydro limits residential systems to 100 kilowatts, ensuring the program remains accessible while providing generous capacity for most homes. The application process is straightforward, with BC Hydro handling the technical requirements once your installer submits the necessary documentation.

Municipal and Regional Grants Worth Checking

Beyond provincial programs, many BC municipalities recognize the value of local solar adoption and offer their own financial incentives. These regional grants can significantly boost your solar investment when combined with provincial rebates.

The City of Vancouver provides property tax exemptions for solar installations through their Renewable Energy Systems Property Tax Exemption program, which can save homeowners hundreds of dollars annually. Victoria offers development cost charge reductions for buildings incorporating renewable energy systems, making solar more affordable for both residential and commercial projects. In Kelowna, residents can access streamlined permitting processes and fee waivers that reduce the administrative burden and upfront costs of going solar.

Smaller communities are getting creative too. Surrey has launched sustainability grants for residents making energy-efficient upgrades, while Richmond offers rebates through their environmental programs. Some municipalities provide low-interest financing options or expedited permit approvals, which might not reduce direct costs but certainly make the transition smoother and more affordable overall.

Since municipal programs change regularly and vary widely by location, the best approach is contacting your local government directly. Check your city or regional district’s website under sustainability, environment, or energy sections. Many municipalities have dedicated staff who can walk you through available incentives and help you navigate the application process. When combined with CleanBC programs, these local incentives can make your solar journey surprisingly affordable while supporting your community’s clean energy goals.

Federal Programs That Actually Apply to BC Solar Projects

While federal tax rebates don’t exist in Canada’s system, BC residents can access two significant federal programs designed specifically to support home energy upgrades, including solar installations.

The Canada Greener Homes Grant provides up to $5,000 for eligible home retrofits. To qualify for solar-specific funding, homeowners must first complete an EnerGuide home energy evaluation, which costs between $300-600 but is reimbursed upon program completion. Solar photovoltaic systems qualify for up to $5,000, though the actual amount depends on your system size and your home’s energy assessment results. The process involves three steps: register for the program, complete your pre-retrofit evaluation, and submit your application within 12 months of your initial assessment.

The Canada Greener Homes Loan complements the grant by offering interest-free financing up to $40,000 over ten years. This loan helps bridge the gap between the grant amount and your total project cost. For example, if your solar installation costs $20,000, you could receive $5,000 from the grant and finance the remaining $15,000 interest-free. The monthly payments work out to just $125 with no interest charges, making solar considerably more affordable.

Both programs require using certified contractors and approved equipment, so verify your installer’s qualifications before proceeding. The application process happens online through Natural Resources Canada’s portal, where you’ll create an account, upload your energy evaluation, and track your application status.

One Vancouver homeowner, Maria Chen, combined both programs with BC’s provincial incentives to reduce her $18,000 system cost by nearly 40 percent. She completed the entire application process in under two hours and received her grant payment within eight weeks of installation completion.

For those seeking zero upfront costs, solar power purchase agreements offer an alternative that doesn’t require applying for these federal programs, though the grants can significantly reduce ownership costs for those purchasing systems outright.

Real Numbers: What a BC Homeowner Actually Pays After Incentives

Meet the Chen family from Coquitlam, who installed a 7 kW solar system on their home in 2024. Their experience shows exactly what BC homeowners can expect when going solar.

The Chens received quotes averaging $21,000 for their system before any incentives. Here’s how the numbers broke down:

Total system cost: $21,000

First, they qualified for CleanBC’s rebate of $5,000 (available for systems under 10 kW through participating installers). This brought their cost down to $16,000.

Next, they saved $1,050 through the PST exemption. British Columbia doesn’t charge the 7 percent provincial sales tax on residential solar equipment and installation, which meant an automatic discount at purchase.

Their municipality of Coquitlam also offered a property tax exemption for the added home value from solar panels, saving them approximately $150 annually.

Final out-of-pocket cost: $15,950

The Chens’ system generates about 7,800 kWh annually, reducing their electricity bills by roughly $900 each year. At this rate, they’ll recover their investment in approximately 18 years. However, with BC Hydro’s rising electricity rates, this payback period will likely shorten.

For homeowners unable to pay upfront costs, solar PPAs offer an alternative with zero initial investment.

The key takeaway from the Chens’ experience is that combining provincial rebates with PST exemptions makes solar significantly more affordable than the sticker price suggests. Your actual costs will vary based on system size, roof conditions, and local incentives, but this example demonstrates the realistic financial picture BC homeowners face when transitioning to clean energy.

Your Next Steps to Claim These BC Solar Benefits

Ready to capture BC’s solar benefits? Here’s your step-by-step roadmap to getting started.

Begin by assessing your property’s solar potential and calculating your estimated savings. This helps you understand which programs apply to your situation and what financial benefits you can expect. Connect with Solar BC to access our interactive savings calculator and explore alternative financing options that suit your budget.

Next, reach out to a certified solar installer who understands BC’s incentive landscape. Solar BC maintains a network of experienced installers who can guide you through program eligibility and application timelines. They’ll evaluate your home or business, design a system that maximizes your rebates, and help you navigate the documentation process.

For the CleanBC Better Homes rebate, apply before installation begins. You’ll need property details, income verification for low-income tiers, and quotes from qualified installers. Business owners should explore provincial and federal programs through their installer, who can identify applicable incentives based on your sector and project size.

Keep all receipts, permits, and system specifications organized. These documents are essential for rebate claims and net metering applications with BC Hydro. Most installers will help coordinate your net metering setup, ensuring your system connects properly to the grid.

Solar BC is here to simplify this journey. Contact us to connect with certified installers, access planning resources, and join a growing community of BC residents benefiting from clean, affordable solar energy.

While federal tax rebates for solar panels don’t exist in Canada, BC residents actually benefit from something better: a comprehensive support system of provincial incentives combined with federal programs that work together to make solar energy accessible and affordable.

The CleanBC program, federal Canada Greener Homes Grant, net metering policies, and various municipal rebates create a financial package that rivals incentive structures anywhere in North America. Many BC homeowners have already made the switch and are seeing substantial energy savings within their first year of operation.

Take the Johnson family in Victoria, who reduced their annual electricity costs by 65% after installing solar panels with help from available incentives. Or the small business in Kelowna that achieved payback on their solar investment in under eight years while reducing their carbon footprint.

Ready to explore how much you could save? Use Solar BC’s interactive calculator tool to get personalized estimates based on your specific location, roof characteristics, and energy needs. The tool provides a clear breakdown of available incentives and projected savings over time.

Connect with local certified solar installers who understand BC’s incentive landscape and can guide you through the application process. Making the transition to clean energy has never been more achievable for BC residents.